- Article

- Global Research

- Automation

HSBC Research: Downunder Digest

Australia’s weak productivity growth is weighing on national income and living standards, and also has implications for inflation and interest rates. HSBC’s Paul Bloxham explains.

- Productivity growth has been very weak in recent years, with Australia’s output per hour worked currently at its 2016 level

- This is weighing on national income and living standards, and contributing to the sticky inflation problem

- Pandemic-related policy measures likely weakened the cyclical upswing in productivity; structural challenges remain

Australia’s productivity problems

“Productivity isn’t everything, but in the long run it is almost everything”, Paul Krugman famously quipped in 1994. For Australia, a large resource endowment has meant that productivity has not needed to be everything in recent decades.

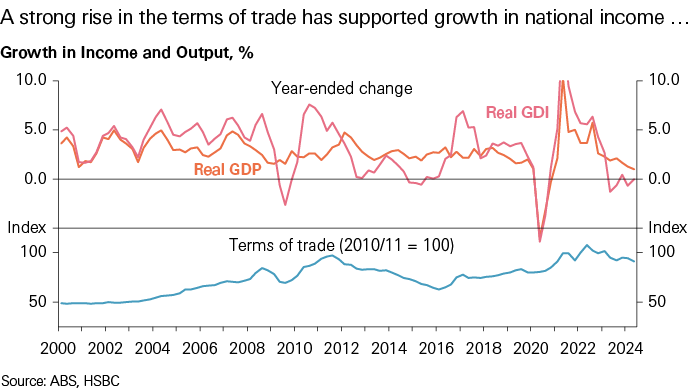

Economic success, reflected in the strong growth of Australia’s national income, has been underpinned by resources exports – mostly iron ore, coal and gas – which have risen in value by a stunningly large 750% over the past two decades, as China emerged.

But ‘peak steel’ is likely to have already passed, ‘peak coal’ is coming soon (the IEA forecasts it to be later this decade), and ‘peak gas’ is likely to be a little further down the track. Australia’s ‘luck’ is unlikely to get repeated. To lift national incomes from here, Australia needs to focus on improving its productivity.

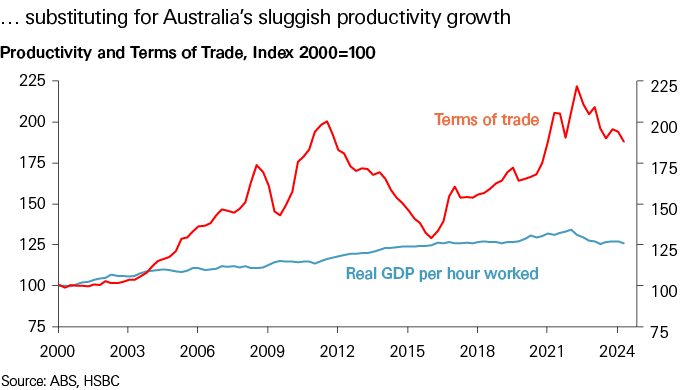

Weak productivity has been an issue for many years now, and, as we have argued, a lack of focus on reform is likely to have been one of the ‘resources curses’. Pre-pandemic, sluggish productivity growth was already an evident challenge. The recent performance has been dismal, with output per hour worked no higher now than in 2016.

The recent weakness may reflect the design of the pandemic-related response as it may have lowered business dynamism, while a tight jobs market may be exacerbating skills and geographical mismatches. Fundamentals, such as weak business investment, have also been a factor. Australia’s policy settings, particularly regarding competition, tax, investment and industrial relations have not been ideal for lifting productivity. A recent boost to public health and aged-care spending is playing a role. There is a clear need for a broader reform agenda focused on productivity.

Weak productivity is an inflation risk as well. Despite some recent slowing in wages growth, weak productivity is keeping unit labour costs too high, and is a factor that is likely to mean the RBA will only gradually ease policy, if at all.

Would you like to know more? Click here to read a full version of the report. Please note, you must be a subscriber to Global Research to access this link.

To learn more about Global Research, including how to subscribe, email us at AskResearch@hsbc.com.

Disclosure appendix

The following analyst(s), who is(are) primarily responsible for this document, certifies(y) that the opinion(s), views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Paul Bloxham and Jamie Culling

This document has been issued by the Research Department of HSBC.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research.

Additional disclosures

- This report is dated as at 26 November 2024.

- All market data included in this report are dated as at close 25 November 2024, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

Issuer of report

HSBC Bank Australia Limited

This document has been issued by HSBC Bank Australia Limited, which has based this document on information obtained from sources it believes to be reliable but which it has not independently verified. Neither HSBC Bank Australia Limited nor any member of its group companies (“HSBC”) make any guarantee, representation or warranty nor accept any responsibility or liability as to the accuracy or completeness of this document and is not responsible for errors of transmission of factual or analytical data, nor is HSBC liable for damages arising out of any person’s reliance on this information. The information and opinions contained within the report are based upon publicly available information at the time of publication, represent the present judgment of HSBC and are subject to change without notice.

This document is not and should not be construed as an offer to sell or solicitation of an offer to purchase or subscribe for any investment or other investment products mentioned in it and/or to participate in any trading strategy. It does not constitute a prospectus or other offering document. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

The decision and responsibility on whether or not to purchase, subscribe or sell (as applicable) must be taken by the investor. In no event will any member of the HSBC group be liable to the recipient for any direct or indirect or any other damages of any kind arising from or in connection with reliance on any information and materials herein.

Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognised market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors.

This document is for information purposes only and may not be redistributed or passed on, directly or indirectly, to any other person, in whole or in part, for any purpose. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. By accepting this report, you agree to be bound by the foregoing instructions. If this report is received by a customer of an affiliate of HSBC, its provision to the recipient is subject to the terms of business in place between the recipient and such affiliate. The document is intended to be distributed in its entirety. Unless governing law permits otherwise, you must contact a HSBC Group member in your home jurisdiction if you wish to use HSBC Group services in effecting a transaction in any investment mentioned in this document.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document.

HSBC and/or its officers, directors and employees may have positions in any securities in companies mentioned in this document. HSBC may act as market maker or may have assumed an underwriting commitment in the securities of companies discussed in this document (or in related investments), may sell or buy securities and may also perform or seek to perform investment banking or underwriting services for or relating to those companies and may also be represented on the supervisory board or any other committee of those companies.

From time to time research analysts conduct site visits of covered issuers. HSBC policies prohibit research analysts from accepting payment or reimbursement for travel expenses from the issuer for such visits.

In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is distributed by HSBC Bank Australia Limited (ABN 48 006 434 162 AFSL No. 232595).

© Copyright 2024, HSBC Bank Australia Limited, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of insert issuing entity name. MCI (P) 008/01/2024, MDDI (P) 006/09/2024, MDDI (P) 004/10/2024, MDDI (P) 020/10/2024