- Video

- Global Research

- General Research Insights

New Zealand in 2025

- GDP growth is set to pick up in 2025, as lower interest rates support increased household and business activity

- The jobs market is set to stabilise with a recovery likely to lag the cycle; softening wages growth should ensure subdued inflation

- While fiscal consolidation is ongoing, policymakers ought to focus on improving weak productivity, which is the key longer-term issue

Can the ‘rock star’ status be restored?

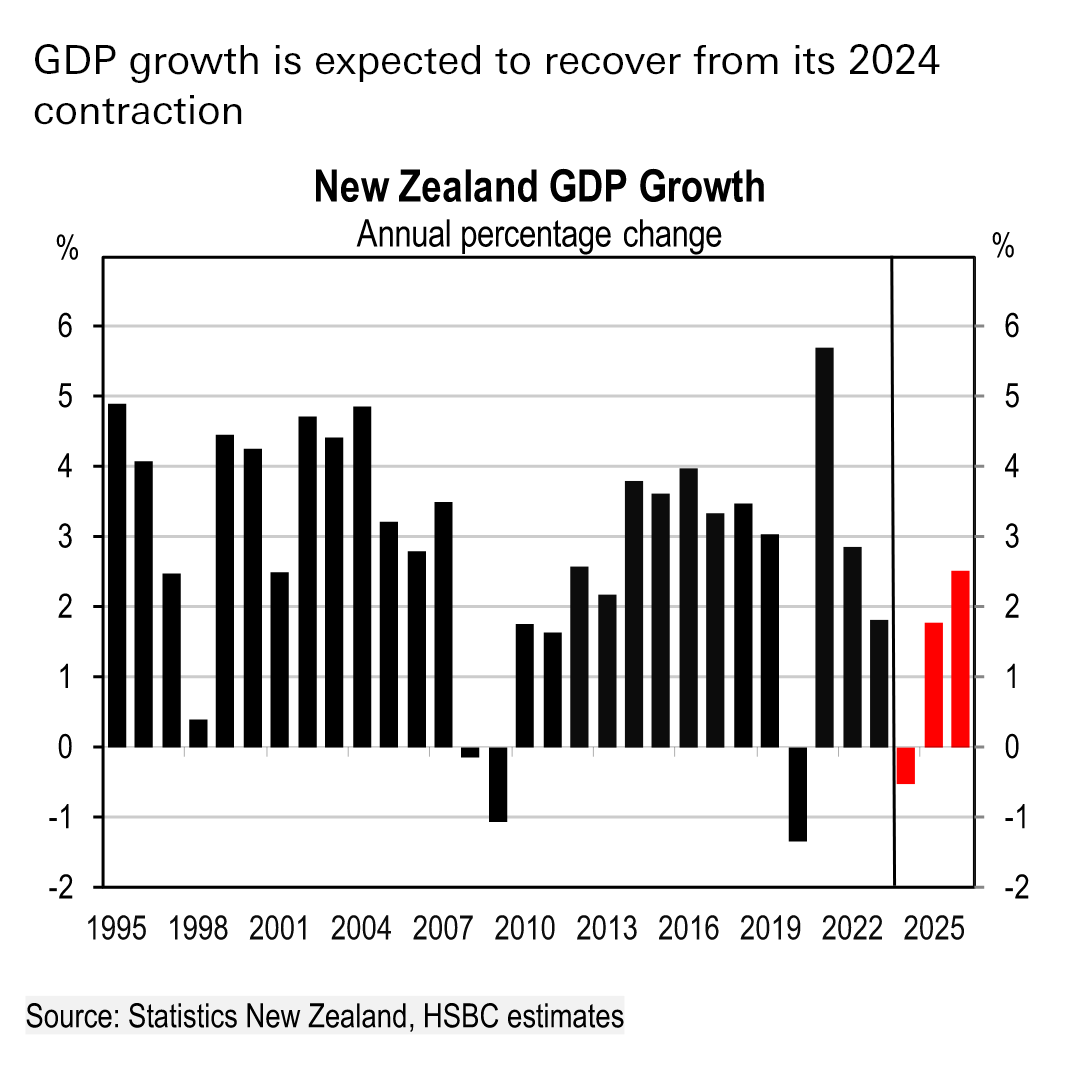

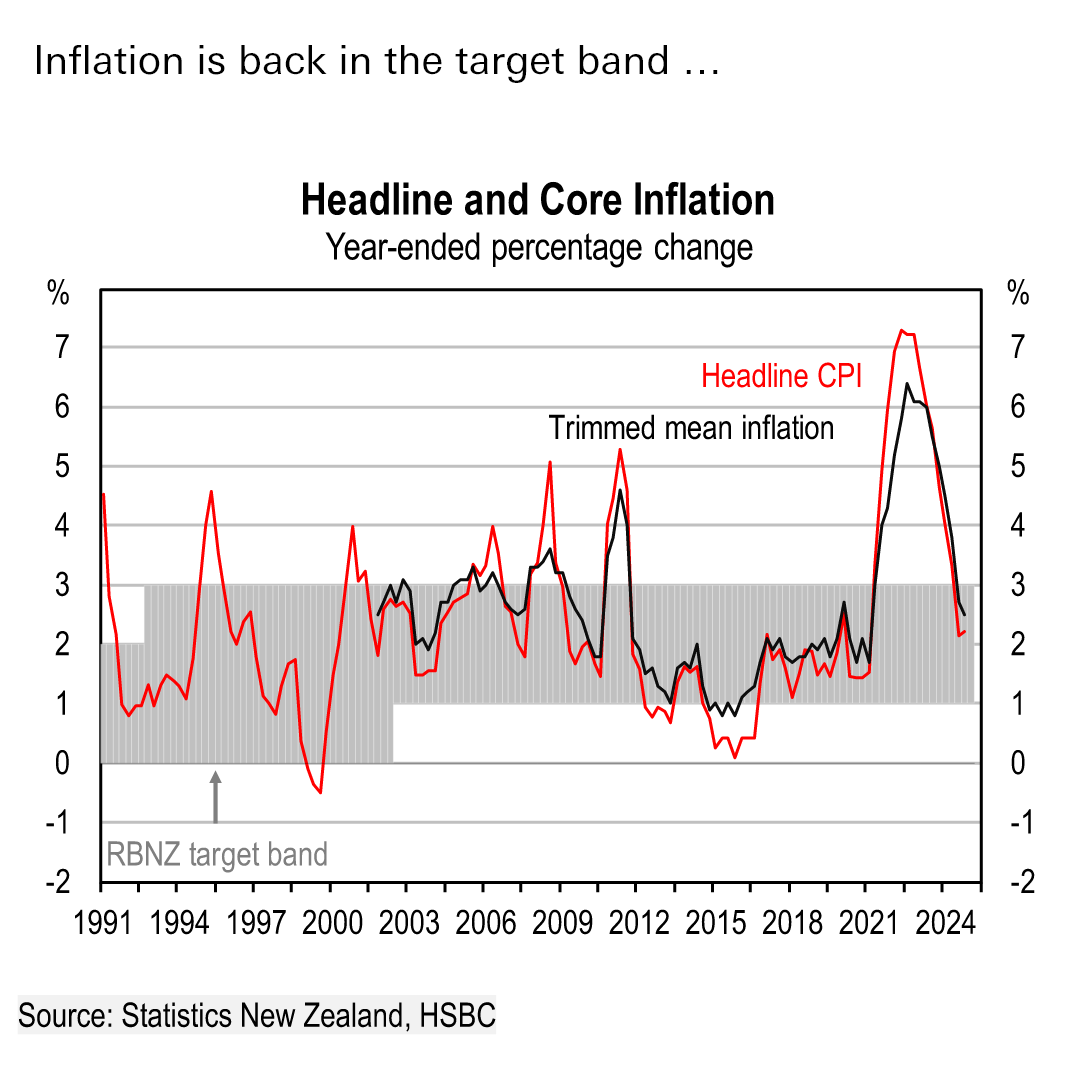

Interest rate moves have driven a big economic cycle in New Zealand. In response to the post-pandemic high inflation challenge, the RBNZ hiked substantially, lifting its cash rate by 525bp to 5.50% from late 2021 to mid-2023. In 2024, the impacts of this tightening on activity were clear – New Zealand tipped into a recession and the unemployment rate rose sharply. Across the developed world, HSBC’s estimates suggest New Zealand’s economy had the largest contraction in GDP in 2024.

This recession also helped to lower inflation, which fell back into the RBNZ’s 1-3% target band for the first time in three years. In turn, it allowed the RBNZ to sharply pivot in August 2024, and it has delivered 125bp of cuts since then. We see a further 125bp of cuts by Q3 2025, taking the cash rate to 3.00%, and expect this to pump-prime a strong growth upswing. After a particularly tough year in 2024 – we estimate that GDP fell by 0.5% that year – we forecast GDP growth lifting to 1.8% in 2025.

There are already some early signs of growth picking up. Business and consumer surveys have both improved, while card spending figures have also risen. The housing market appears to be stabilising, as mortgage lending has increased. While weakness in the jobs market is likely to still weigh on activity in the near-term, we see the unemployment rate peaking and starting to fall later in 2025.

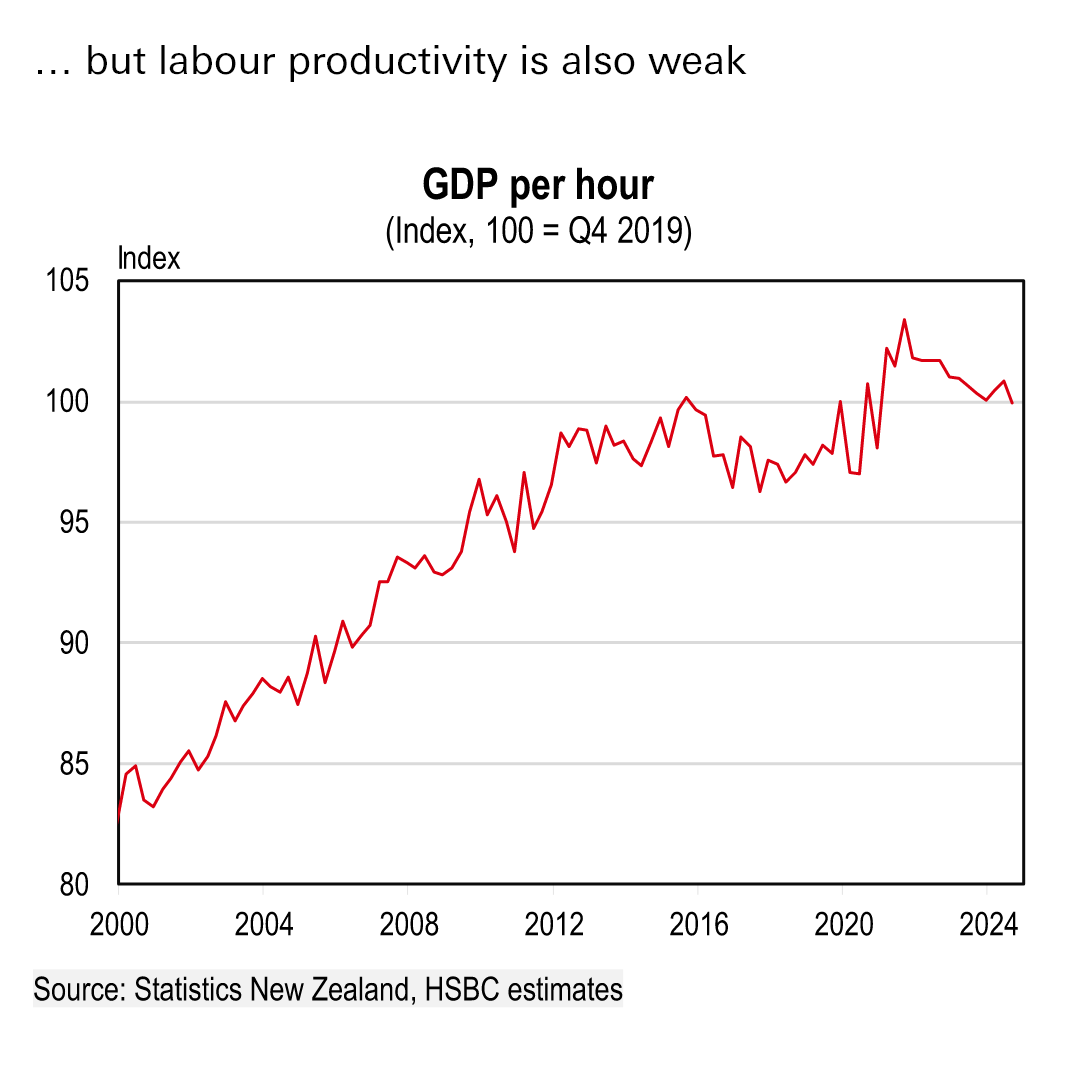

In short, New Zealand’s outlook in 2025 is a good deal more positive than in recent years. However, the longer-term outlook is more challenged by weak productivity. Although this is not a new challenge, productivity outcomes have been notably subdued post-pandemic. Policymakers ought to have a greater focus on ‘growing the economic pie’ and this requires a bold reform agenda and private sector support.

1.8%

New Zealand’s 2025 GDP growth forecast, HSBC

2.2%

New Zealand’s 2025 Inflation forecast, HSBC

We see that reforms could be spread across a number of areas. Reducing regulatory obstacles, improving competition, and attracting foreign investment, alongside targeted use of the public sector balance sheet, are among the ideas. A focus on improving New Zealand’s ‘growth engines’ would also help. We see agricultural and services exports as two key areas which can further support the economy.

Would you like to know more? Click here* to read the full report. Please note, you must be a subscriber to HSBC Global Research to access this link.

To find out more about HSBC Global Research, including how to subscribe, please email us at AskResearch@HSBC.com

* Please note that by clicking on this link you are leaving the HSBC Global Banking & Markets Website, therefore please be aware that the external site policies will differ from our website terms and conditions and privacy policy. The next site will open in a new browser window or tab.

The following analyst(s), who is(are) primarily responsible for this document, certifies(y) that the opinion(s), views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Jamie Culling and Paul Bloxham

This document has been issued by the Research Department of HSBC.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research.

Additional disclosures

- This report is dated as at 24 January 2025.

- All market data included in this report are dated as at close 23 January 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document has been issued by HSBC Bank Australia Limited, which has based this document on information obtained from sources it believes to be reliable but which it has not independently verified. Neither HSBC Bank Australia Limited nor any member of its group companies (“HSBC”) make any guarantee, representation or warranty nor accept any responsibility or liability as to the accuracy or completeness of this document and is not responsible for errors of transmission of factual or analytical data, nor is HSBC liable for damages arising out of any person’s reliance on this information. The information and opinions contained within the report are based upon publicly available information at the time of publication, represent the present judgment of HSBC and are subject to change without notice.

This document is not and should not be construed as an offer to sell or solicitation of an offer to purchase or subscribe for any investment or other investment products mentioned in it and/or to participate in any trading strategy. It does not constitute a prospectus or other offering document. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

The decision and responsibility on whether or not to purchase, subscribe or sell (as applicable) must be taken by the investor. In no event will any member of the HSBC group be liable to the recipient for any direct or indirect or any other damages of any kind arising from or in connection with reliance on any information and materials herein.

Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognised market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors.

This document is for information purposes only and may not be redistributed or passed on, directly or indirectly, to any other person, in whole or in part, for any purpose. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. By accepting this report, you agree to be bound by the foregoing instructions. If this report is received by a customer of an affiliate of HSBC, its provision to the recipient is subject to the terms of business in place between the recipient and such affiliate. The document is intended to be distributed in its entirety. Unless governing law permits otherwise, you must contact a HSBC Group member in your home jurisdiction if you wish to use HSBC Group services in effecting a transaction in any investment mentioned in this document.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document.

HSBC and/or its officers, directors and employees may have positions in any securities in companies mentioned in this document. HSBC may act as market maker or may have assumed an underwriting commitment in the securities of companies discussed in this document (or in related investments), may sell or buy securities and may also perform or seek to perform investment banking or underwriting services for or relating to those companies and may also be represented on the supervisory board or any other committee of those companies.

From time to time research analysts conduct site visits of covered issuers. HSBC policies prohibit research analysts from accepting payment or reimbursement for travel expenses from the issuer for such visits.

In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is distributed by HSBC Bank Australia Limited (ABN 48 006 434 162 AFSL No. 232595).

© Copyright 2025, HSBC Bank Australia Limited, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of insert issuing entity name. MDDI (P) 005/01/2025, MDDI (P) 006/09/2024, MDDI (P) 004/10/2024, MDDI (P) 020/10/2024